Second Generation Health Insurance Expert

Dawn Kyle

Direct Line: 800-913-2208

View

My Online Appointment Scheduling System

Hello, I’m Dawn Kyle and welcome to HSA for America. You’ve come to the right place to get honest answers so you can make sense of all the choices you have whether you're looking for individual health insurance or a way to cover your whole family. I know because I began learning about health insurance when I was just a child.

I grew up in south Mississippi going to visit my dad’s “insureds” and watching him help people find insurance. My parents influenced me more than anyone else by showing me that if I always do the right thing, I will never regret my choice. Mom influenced me by instilling character and integrity. My dad influenced me with his work ethic and the care he took with his clients. I hope the legacy I pass on is that I made a difference in the world one day and one person at a time.

Having raised four kids, I know how important it is to find health insurance you can count on at an affordable price. I ask myself every morning: How can I make a difference in the life of someone else today?

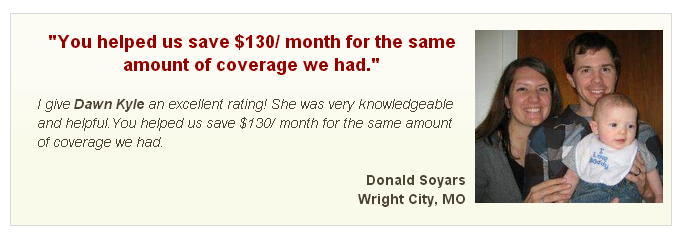

Dawn with Josh and Patrick

Bekah and Jesse

When I became single again (with four young children), I could have chosen to live on the sympathy and understanding of family and friends, but I wanted to set a better example for my children. I am happiest when spending time with my family. Now that my children live in four different states, it is important to me to have contact with each one weekly. My greatest happiness now is being with my granddaughter.

Hannah, Taylor and Madelyn

I chose to live in such a way that I could say I not only survived - I lived victoriously!Some of my most challenging and rewarding experiences have been helping internationals understand our somewhat confusing health care system. (Many agents don’t want to help them because of the cultural and language barriers.)It was not uncommon for someone from another country to bring a friend to my office unannounced, knowing that I would drop what I was doing and answer questions.

I will listen to you and do what it takes to help you find a good solution to your problem, too. I am always honest with my clients and one of my strengths lies in communicating complex insurance ideas. That’s how I can help you make the right choice for your situation and have the peace of mind that comes with knowing you’ve made the best decision for yourself and your family.

I can show you how to save on both premiums and taxes with what’s known as a Health Savings Account (HSA). To open one of these tax-advantaged accounts, you must have health insurance that’s qualified to work as an HSA Plan. These plans have deductibles between $1,250 and $6,350 for individuals and between $2,500 and $12,700 for families. The best part is that premiums typically cost about 30 or 40 percent less than co-pay coverage. You can invest what you save in your HSA for tax-free earnings that grow like an IRA.

Some people cut their taxes by as much as $2,064 because you can take a tax deduction (even if you don’t itemize) for money you contribute to your HSA. You can deposit up to $3,300 for an individual HSA or up to $6,550 for a family account, but there is no minimum deposit requirement. Whatever you deposit by April 15 is an "above the line" tax deduction.

Use what you save on taxes and premiums to build your HSA in case you ever need to meet the deductible. Preventive health care is already 100 percent covered with no deductible. Instead of paying an insurance company a high premium for services you may not need, an HSA gives you the choice to invest in your future.

Let your savings grow tax free as a retirement fund and, unlike standard IRAs, the money remains accessible to pay for a wide range of health care. You can withdraw funds at any age to go to the dentist or chiropractor, for acupuncture or homeopathy, or for many services that insurance rarely covers. Of course, you can use your HSA for doctor and hospital bills, too.

In fact, you can use your HSA to pay for qualified health care for your spouse, partner, or a dependent even if they are not covered by your policy.

From experience, I’ve see how important health insurance is even when you’re healthy. I had a client who considered terminating his insurance. One day he stepped in a bed of rattlesnakes while hiking in the Rocky Mountains. Even with multiple bites, he managed to walk for help and survived. His hospital bill was over $150,000, though. With his HSA Plan, he only had a $2,500 deductible followed by 100-percent coverage. After paying just $2,500 for a $150,000 bill, he never thought about cancelling again.

I enjoy working with HSA for America or because I like the integrity of this company. It gives me a terrific platform to do what I love – help people. A business should operate with the highest level of integrity and always do what is best for the client. I think you should treat everyone as the most important person you talk to each day. The motto I try to live by is always do the right thing and do it with excellence.

I look forward to the chance to help you and your family get the most from your health insurance coverage.

Dawn Kyle

DawnKyle@HSAforAmerica.com

Direct Line: 800-913-2208

View My Online Appointment Scheduling System